Most small business owners think insurance is just a formality. A checkbox. A “just in case.” Until something breaks: someone sues, or an accident turns one bad day into a five-figure loss.

That’s when it hits: You don’t rise to the occasion—you fall back on your systems. And if you don’t have the right insurance? There’s nothing to catch you.

Every business has blind spots. Maybe it’s the delivery van you use once a week. The contractor on your team. The equipment you leave in the truck overnight. Or the product that suddenly “caused harm.”

That’s where small business insurance comes in. Not one-size-fits-all, but tailored protection for the real risks hiding in plain sight.

In this guide, we’ll break down 7 types of insurance that can mean the difference between a minor setback and a major shutdown—so you’re not caught off guard when things go sideways.

General Liability Insurance: The First Line of Defense Against the Unexpected

If your business interacts with people, products, or property—you need this. General liability insurance is the foundation of any strong risk strategy. It protects you from third-party claims like:

- Someone tripping on your welcome mat

- Damaging a client’s property during a job

- Even being accused of defamation or slander

And no—it’s not just for brick-and-mortar shops. Even if you work remotely or run an online service, general liability has your back when you’re dealing with clients or contractors.

Legal claims—even minor ones—can cost thousands just in defense fees. General liability coverage absorbs that hit, so you don’t have to.

Example:

A handyman accidentally knocks over a $6,000 antique vase while fixing a customer’s ceiling fan. The client sues for damages. The insurance pays for replacement costs and legal fees. Without it? That’s a major hit to the business’s bank account.

Make sure your policy includes product liability if you manufacture, sell, or distribute anything. That’s usually bundled in—but don’t assume. Check the fine print.

Professional Liability Insurance: When a Simple Mistake Becomes a Lawsuit

You did everything right. But the client still isn’t happy—and now they’re threatening legal action.

Professional liability insurance (also known as Errors & Omissions) protects you when your service—or advice—is blamed for causing financial harm. Even if the claim is groundless, you’ll still need to lawyer up. That’s where this coverage comes in.

Who needs it?

- Consultants

- Designers

- Coaches

- Accountants

- Marketers

- Freelancers of any kind

Example:

A business consultant advises a retail client to invest in a rebrand. The launch flops. Sales drop. The client sued, claiming the bad advice caused the loss. Professional liability helps cover the legal defense and any settlement—so the consultant doesn’t pay out of pocket.

If you send invoices for your expertise, you need this coverage. Clients have short memories when things go wrong—and it’s your name on the contract.

Because in business, “I didn’t mean to” won’t keep you out of court. But professional liability insurance just might.

Workers’ Compensation Insurance: Taking Care of Your Team (and Your Business)

Even in a chill workspace, accidents happen. One awkward lift, one wet floor, one repetitive motion—and suddenly, an employee’s out for weeks. Medical bills pile up. Paychecks need to keep flowing. And guess who’s legally responsible? You.

Workers’ compensation insurance covers:

- Medical expenses for work-related injuries

- Lost wages during recovery

- Legal fees if your employee sues over unsafe conditions

And here’s the catch: In most states, it’s not optional. If you have employees, you’re required by law to carry workers’ comp. No gray area.

Example:

A florist slices her hand on a broken vase during a busy Valentine’s rush. She needs stitches and a few days off. Workers’ comp covers her ER visit and lost wages—without dipping into the business’s cash reserves.

Even if you only hire part-timers, freelancers, or seasonal help—check your state laws. You may still be on the hook if they get hurt while working for you.

Because taking care of your people isn’t just good business—it’s protected business.

Commercial Property Insurance: Protecting the Place Where Business Happens

You’ve built something—an office, a studio, a kitchen, a workspace. It holds your gear, your tools, your inventory… your livelihood.

Now picture it gone.

Fire. Theft. A busted pipe that floods everything. Without commercial property insurance, you’re paying out of pocket to rebuild from scratch.

This coverage protects your physical assets, including:

- Buildings and structures

- Equipment, tools, and furniture

- Inventory and supplies

- Even signage

Example:

A photography studio experiences an electrical fire that destroys lighting rigs, backdrops, and editing stations. Property insurance covers replacement costs—fast—so the studio can get back to business before clients walk away.

Renting your space? You still need coverage. Many landlords won’t cover what’s inside the space—your equipment, your materials, your stuff. And if you work from home, your homeowner’s insurance likely won’t cover business-related damage.

If you can touch it, and your business needs it, you should insure it.

Commercial Auto Insurance: Business Vehicles Need More Than a Personal Policy

Got a van for deliveries? A car for client visits? A pickup for hauling gear?

If it moves your business forward, it needs commercial auto coverage. Because personal car insurance doesn’t cover business use, and if you get into an accident on the job, your claim could be denied completely.

Commercial auto insurance covers:

- Vehicle damage (yours and others)

- Medical bills for injuries

- Legal costs from accidents

- Theft or vandalism

Example:

A landscaper’s truck is rear-ended on the way to a job site. The trailer is totaled, and the tools are damaged. Commercial auto covers the repairs and helps replace the ruined gear.

Even if your team uses their own cars for work (called “non-owned auto”), you can still be held liable in an accident. Make sure your policy includes hired and non-owned auto coverage if that’s the case.

When wheels are part of your business, so is risk. The right insurance keeps you on the road—and out of legal trouble.

Tools & Equipment Insurance: Coverage That Moves With You

If your gear gets stolen, damaged, or lost—can you keep working tomorrow?

For a lot of small businesses, the answer is no.

Tools & equipment insurance covers your essential gear wherever you take it—on the job site, in your van, at a client’s location, or even in storage.

This isn’t your basic property coverage. This is portable protection for the tools that power your business.

Example:

An electrician leaves their toolbag locked in the truck overnight. Someone breaks in, and $4,000 worth of equipment vanishes. This policy kicks in fast to replace it—no delay, no drama.

Keep a running inventory of your tools (with photos and receipts if possible). It makes the claims process smoother and helps you know if your policy limits are high enough.

Whether you’re a contractor, a DJ, or a mobile pet groomer—if your tools are your business, this coverage is a must.

Product Liability Insurance: Because One Defective Item Can Cost You Everything

You trust your product. You’ve tested it. You’ve sold dozens—maybe hundreds—without a problem.

But then someone claims it made them sick. Or broke their stuff. Or worse.

Product liability insurance protects your business if a product you make, sell, or distribute causes harm or damage. And yes—it even covers claims from products you didn’t manufacture yourself.

Even if you follow every rule, things can go wrong in the supply chain, with packaging, or just one user having a bad reaction.

Example:

A handmade soap company gets sued after a customer has a severe allergic reaction. The ingredients were listed. The customer didn’t check. Doesn’t matter. The lawsuit still lands—and product liability coverage covers the legal defense and potential settlement.

You have a high risk if your product touches the skin, goes in the mouth, or plugs into a wall. Make sure product coverage is in your general liability policy—not all policies include it by default.

Because in the eyes of the law, “we’ve never had that happen before” isn’t a defense. Insurance is.

Insurance Isn’t for the What-Ifs—It’s for the When

Running a business means taking risks. That’s part of the game. But losing everything because of one accident? One claim? One moment of bad luck? That’s a risk you don’t have to take.

Small business insurance doesn’t just protect your stuff—it protects your time, your team, your reputation, and your future.

Each of these policies covers a specific part of your business that actually matters. And together? They make you nearly disaster-proof.

Don’t wait for something to go wrong. Take the smart route: review your coverage, fill in the gaps, and make sure your business can take a hit—and bounce back.

✅ Ready to Get Covered the Easy Way?

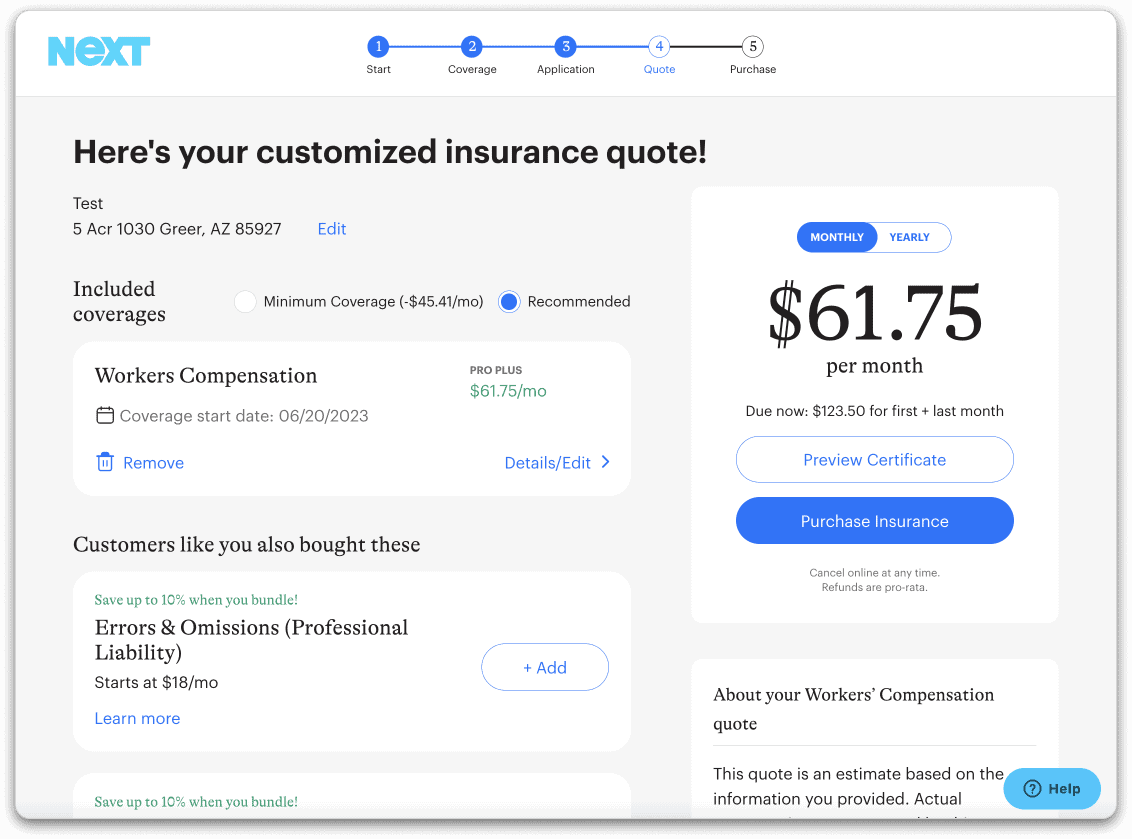

Turbify has teamed up with NEXT Insurance to make business insurance faster, simpler, and built just for you.

👉 Check out your options and get a quote in minutes. Because the best time to prepare was yesterday. The second best? Right now.

Latest Posts:

- Why Your Business Emails Go to Spam (and the 20-Minute Fix)

- Answer Pages That Win: The Small Business FAQ Template That Brings Leads

- How to Get Your Business Cited in Google’s Artificial Intelligence Answers

- How Online Reviews Help You Get More Local Customers (and What to Do This Week)

- Do I Need a Website If I Already Have Social Media? Honest Expert Answers for Small Businesses