Presumably, analysis of data holds the promise of increase in growth and profitability of any business. This presumption leads to wide adoption of any technology that has “big data” or “analytics” in its name, as well as massive venture capital investment in the sector.

Presumably, analysis of data holds the promise of increase in growth and profitability of any business. This presumption leads to wide adoption of any technology that has “big data” or “analytics” in its name, as well as massive venture capital investment in the sector.

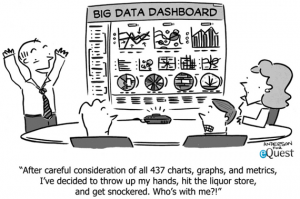

The number of companies that sell services and tools to aggregate, store and process very large volumes of data is astonishing. In addition, there is a dazzling number of companies offering “free” analytics and data visualization tools. Yet, there are very few companies that can claim success of achieving growth and profitability goals after investing a lot of money, efforts and political capital.

Let me make it clear – I sell customer experience analytics services and I am not in a position to throw stones at technology providers or data scientists. My beef is with the upside-down approach taken by many organizations in attempts to leverage data analysis into the production of profitable decisions.

Those who believe that bigger data possesses unreasonable effectiveness will invariably be disappointed. Many believe the more data you have, the more unexpected insights will rise from it, and the more previously unseen patterns will emerge. This is the religion of big data that promises to defy the gravity of management science. While I do believe in miracles, I am very skeptical about being able to buy them from third parties.

“Big data is like counting grains of rice in front of a hungry man. He doesn’t care about the number of grains. He just wants a bowl of cooked rice.” Stephen Yu, Willow Data Strategy

One is not likely to make sound management decisions without knowledge of the specific domain of business. When the domain knowledge meets data analytics many good things start to happen:

- Cultural biases and beliefs, that often act as barnacles impeding your progress, will be challenged;

- Departmental impacts on a business process, that are often overlooked, will get exposed;

- New hypothesis (model) for better business decisions can be created. More data can be identified to test these hypothesis. Better testing produces better, more accurate, models and better models support better decisions: the decisions that make your business grow faster and more profitable.

The role of analytics is to provide support for building predictive models. Predictive modeling is about knowledge of domain and scientific method. Big data can provide and store a lot of additional content for mining, but not much more.

“As for the modeling… it’s like any other science. You learn the domain, then you make the model, then you learn some more. There’s no magic. It does help to learn plain old ordinary statistics, and if you want to do it like Nate Silver you learn a lot of statistics.”

Analytics without domain knowledge, is as likely to provide you with actionable decisions, as a pile of bricks without blueprints is to help you construct a house.

This article was syndicated from Business 2 Community: Why Your Investment In Analytics Is Likely To Be A Complete Waste Of Money

More Technology & Innovation articles from Business 2 Community:

- Why And How To Use Enhanced Ecommerce Feature In Google Analytics

- Intel Smart Clip Makes Sure You Never Forget Baby In The Car [CES 2015]

- Bill Gates Drinks Water That Was Human Feces Minutes Earlier [Watch]

- The Cloud and the Internet of Things

- Facebook Buys Wit.ai, A Startup That Helps People Talk To Electronics