Changes to the way health insurance is delivered and purchased mean more Americans than ever have access to the critical financial protection provided by major medical coverage. That’s good news – and it’s even better news when it’s paired with evidence of a resurgent economy. Unfortunately, the financial upswing hasn’t yet trickled down to U.S. workers’ bank accounts: The 2015 Aflac WorkForces Report reveals that people throughout the nation are struggling with money issues, and it’s not an exaggeration to state that many are just one injury or illness from financial disaster.

Living on the edge

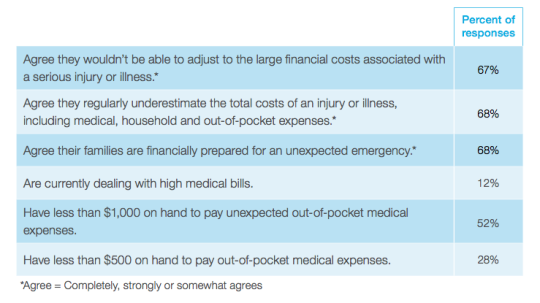

The improving economy may mean better raises and bonuses down the road for U.S. employees, but years of reduced or eliminated raises and bonuses have left some workers in financial turmoil. In many cases, their health care costs – including premiums, deductibles and out-of-pocket expenses – have gobbled up their raises and more. The backslide in take-home pay has left many walking financial tightropes, and even seemingly minor medical expenses threaten to send them tumbling. Consider these employee facts:

The credit conundrum

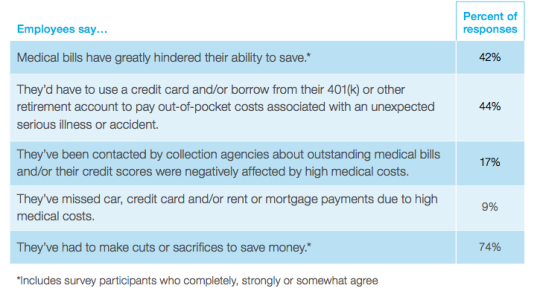

While credit is useful in a pinch, building up a large amount of debt is a financial misstep. Many Americans whose budgets are stretched to the max are forced to use credit to cover medical bills, and the 2015 Aflac WorkForces Report reveals there are often serious consequences. Employees say medical costs are affecting their credit scores, keeping them from paying other bills and thwarting their efforts to save for rainy days or retirement.

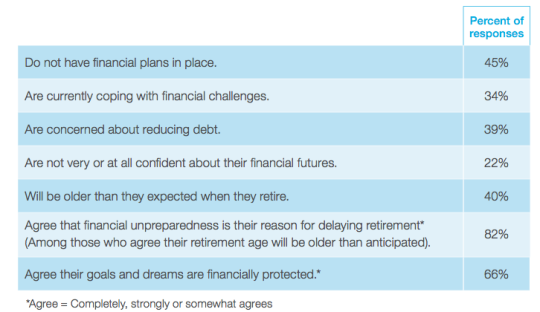

Are Americans financially literate?

The WorkForces Report reveals that many Americans aren’t making the connection between the monetary decisions they make today and the repercussions those decisions will have far in the future. Financial literacy is low, with the majority of workers neglecting not only to save for tomorrow but for eventual retirement. In fact, employees reported that they:

Financial unpreparedness has many Americans tossing and turning: Just 43 percent of those surveyed completely or strongly agree that, given their financial situations, they have peace of mind that allows them to sleep at night.

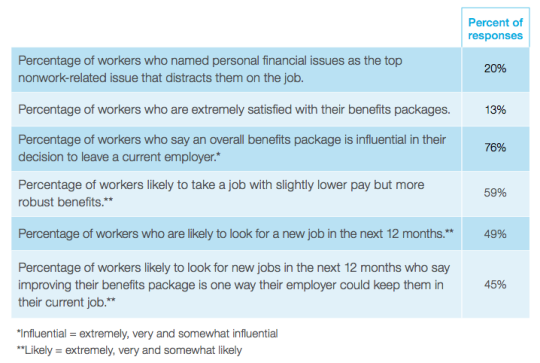

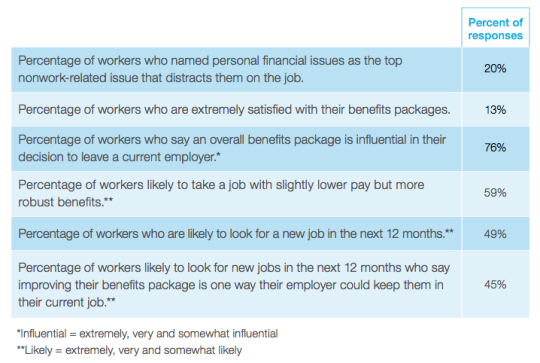

Employers feel the sting of workers’ financial concerns

Why should employers be concerned about their workers’ financial stress? Because those concerns follow employees to work and can result in decreased productivity, workers are distracted. Here are just a few reasons employers should put together strong benefits packages and market those packages to employees with clear, concise and relevant communications.

Location, location, location…

Apparently, location matters in issues other than real estate, because the Aflac WorkForces Report reveals that top health care concerns and related financial issues vary by region. Here’s a look at how things shape up in the Midwest, Northeast, South and West:

- Midwestern employees are more likely than those of any other region to have been contacted by a collection agency about unpaid medical bills.

- Employees in the Northeast are slightly more likely than those of all other regions to consider voluntary benefits an important part of a comprehensive benefits plan.

- Southern workers are less likely than those in all other regions to prefer face-to-face meetings for communications about their employee benefits options.

- Employees in Western states are more likely than those in any other region to say they’d need to borrow from a 401(k) and/or use a credit card to cover unexpected medical costs.

About the study

The 2015 Aflac WorkForces Report is the fifth annual Aflac employee benefits study examining benefit trends and attitudes. The study, conducted in Jan. 2015 by Research Now, captured responses from 1,977 benefits decision-makers and 5,337 employees from across the United States. To learn more about the Aflac WorkForces Report, visit AflacWorkForcesReport.com.

For the purposes of the Aflac WorkForces Report, Midwestern states include Illinois, Indiana Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin. Northeastern states include Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont. Southern states include Alabama, Arkansas, Delaware, District of Columbia, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia. Western states include Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington and Wyoming.