One of my favorite CMO stories is when I was working as the CMO of a large, global company which was under extreme duress. This led to the exit of the CEO, and the entry of a new CEO to resurrect the firm.

Our first conversation went something like this:

CEO: “Randall, what is our global marketing budget?”

Me: “About $xxx million, give or take a bit.”

CEO: “Randall, how much of this cost is contractually committed?”

Me: “About 20%.”

CEO: “Randall, that is your new budget.”

This conversation would be funny if it weren’t so depressing. Yes, the company desperately needed cost savings. Yes, some of the Marketing spend wasn’t backed up by solid evidence as to how or whether it built the brand or improved financial results. And yes, Marketing was considered a cost.

Marketing and accountability is an alarmingly common issue for CMOs. Virtually every survey of Marketers shows that accountability tops their list of concerns year after year. Why is Marketing spend such an issue and what can CMOs do about it?

Making Marketing Accountable

In my recent MENG webinar, “Everything I Needed to Know about Advertising as a CMO, But Didn’t,” one of the key maxims for success that I covered was this:

“Make your CFO your best friend.”

Really? After the “Randall that’s your new budget” debacle? You’d think that I’d run for the hills every time a CEO or CFO came within earshot. Well, you’d think wrong.

For many CMOs, the idea of buddying up to the CFO is frightening, if not downright suicidal. The downside is big: losing some or most of your Marketing budget. Transparency can be a dangerous thing—what if your Marketing spend doesn’t deliver an adequate return?

Yes, that’s a risk for sure. But is it really any more risky than having your CFO consider Marketing to be a cost? That’s the way it’s accounted for in the accounting profession, and that’s the way your CFO will see it unless you help him or her see it otherwise.

Marketing Spend, Brand Value, and Asset Value

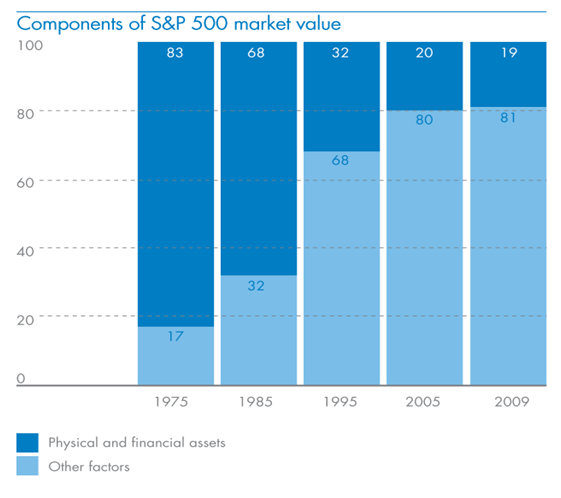

If Marketing is an expense, then why did intangible assets for S&P 500 companies account for 81% of market cap in 2009? Surely, some fraction of the 81% could be attributed to brand value?

Brand valuation estimates for that year ranged widely, but some estimates suggested that as much as 25% of intangible asset value was made up of brand value. And brand value is what marketing is supposed to create, right?

It’s clear that CFOs should really care about marketing as an investment, not a cost. Here’s why. First, brand value makes up a significant portion of market cap. And second, one of the primary functions of marketing is to build brand value. So, it really is smart to make the CFO your best friend. But how?

It’s clear that CFOs should really care about marketing as an investment, not a cost. Here’s why. First, brand value makes up a significant portion of market cap. And second, one of the primary functions of marketing is to build brand value. So, it really is smart to make the CFO your best friend. But how?

How to Make the CFO Your Best Friend

First, educate your CFO on how Marketing builds brand value. The Marketing Accountability Standards Board has done some excellent work in demonstrating the relationship between Marketing spend, brand preference, market share, and brand value. Use this to help your CFO understand the impact of Marketing on brand value, and therefore, market cap. If your CFO doesn’t care about market cap, then you have a different issue.

Second, commit to measuring the impact of Marketing on your business results. The simplest and most straightforward method for doing so is Market Mix Modeling (MMM). MMM produces three simple outputs that are enormously interesting to a CFO:

- Revenue Attribution by Marketing Element—MMM will attribute revenue to each of your Marketing plan elements and will also show how much revenue would have occurred without any marketing at all. This answers the most basic question of all: what impact did Marketing have ?

- Year over Year Revenue Waterfall—MMM will show you each increment and decrement of revenue, by marketing plan element, which led to your year over year revenue increase or decrease. This will help you understand the relative drivers of year over year performance changes.

- Return per $1 Spend—MMM will put all of your Marketing elements on a level playing field and show your financial return for each $1 of spend. This will answer the question: which marketing elements drove the highest and lowest return?

The above three outputs can then be used in predictive models to help you (and your CFO) understand how much you should spend and how you should allocate that spending, to achieve specific volume, revenue, or profit goals. This is something that every CFO will love.

CFO—Friend or Foe?

Is it dangerous to buddy up to you CFO? If they’re irrational and hate every Marketing dollar you ever spent, then it could be. But if they care about market cap, being good stewards of the investments their firm is making, and are focused on improving financial results, they will love you for being bold and stepping up to put real accountability behind your Marketing spend.

Conversations with Your CEO and CFO

If I had taken my own advice years ago and made my CFO my best friend, I could have answered my CEO’s questions with something like this:

Randall: “Yes, we can cut Marketing spend, but the impact on market cap will be a negative x million dollars and the impact on revenue will be a negative Y million dollars.”

CEO: “Randall, so cutting our Marketing investment is a bad idea. Thank you.”

And that’s not a bad idea: Marketing spend as an investment, not a cost. When are you going to start your CFO buddy conversation?

This article was syndicated from Business 2 Community: Marketing Spend — A Strategic Investment or Just a Cost?

More Sales & Marketing articles from Business 2 Community: