As the economy rebounds, small business owners are becoming more optimistic. Thriving startups as well as established businesses, however, are finding it harder and harder to obtain small business loans from traditional banks. Since 2008, overall small business lending has decreased by 15% across the board. Entrepreneurs with excellent credit and cash reserves in the bank are time and again being turned down due to banks’ reluctance to loan to smaller businesses instead of the larger corporations.

Small business loans started to become tougher to obtain in the 2009 fiscal year. Banks, skittish from massive losses incurred in the downturn, raised requirements for small business loans which made it harder than ever before for startups without years of history and lots of capital. Even as recently as October 2012, big banks awarded full loans to only 14.8% of all small business applicants.

Particularly hard hit are businesses seeking loans for less than $100,000, which are typically needed to grow a business in its initial stages. Entrepreneurs, many with pristine credit scores, tell countless stories of being turned down by dozens of banks before ultimately giving up or turning to alternative lenders. By most estimates, in major metropolitan areas small business loan applications are no longer being submitted to banks by between 50 and 60% of all regional business owners for fear of being declined.

Many small business owners have misconceptions about the loan process and particularly, the Small Business Administration (SBA). The SBA does not lend money; rather, it guarantees small business loans made by SBA lenders like traditional banks. Comparable to being approved for an FHA mortgage loan, SBA-backed loans are becoming more stringently regulated and therefore even more difficult to obtain than uninsured small business loans in some cases. SBA loans actually declined by 13% between the 2011 and 2012 fiscal years.

A High Credit Score Does Not Guarantee Loan Approval for Business Owners

A High Credit Score Does Not Guarantee Loan Approval for Business Owners

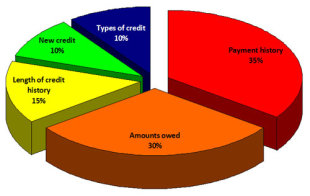

Additionally, many small business owners assume that because they have good credit and money in the bank they will easily be approved. Most lenders look for excellent personal credit in addition to a strong history of business credit before granting loans. Other factors like debt-to-credit ratio, gross income and the number of loan inquiries can also impact an entrepreneur’s likelihood of obtaining a business loan.

If you’ve been turned down for a small business loan or you have questions about your eligibility, contact us at 770-249-2357. Lenders like Triton Financial Solutions can bridge the gap between a small business’ need for capital and a lack of traditional funding options. Many who have been turned down by traditional banks can more easily obtain financing through non-traditional (or alternative) lenders.

More Business articles from Business 2 Community:

- Business Transcription Outsourcing Explained (Part I)

- How to Use Google Analytics for PR

- Real or Ridiculous? Increasing Passive Income & Profits Through Affiliate Marketing

- Craft Beer Marketing: How To Use Social Media To Promote Your Craft Beer Bar

- 3 Signs You Should Improve Your Internet Video Marketing