Sales Managers,

Have you ever noticed that your sales people are making guesses rather than focusing on the facts? One of the most common guessing games is played around the key players involved in a deal. These days, it’s not enough to simply identify a set of contacts in your buyer’s organization; sellers need to know a high level of detail about each stakeholder involved: from their role in the buying decision to how they evaluate your relationship – Your team needs to see the BIG PICTURE in order to develop the relationships needed to win.

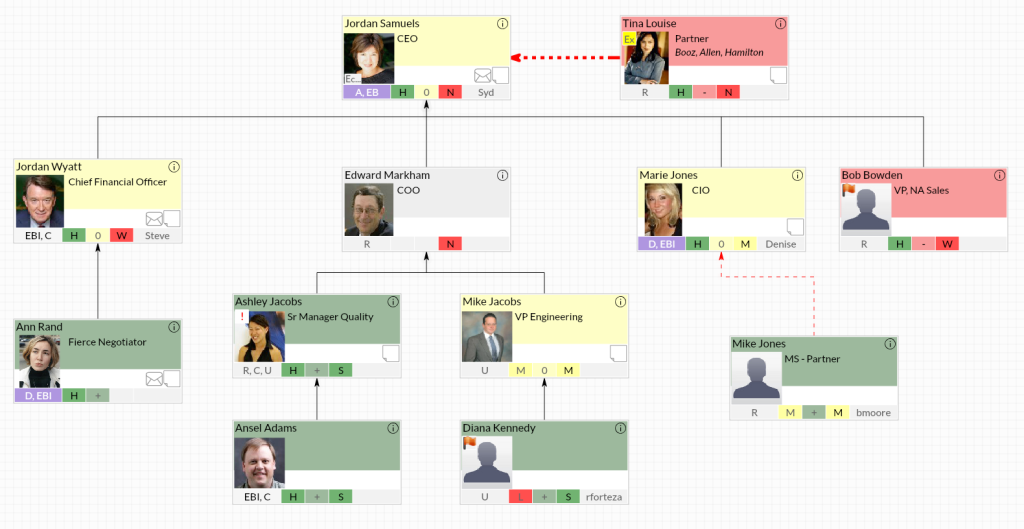

We’ve previously written about the benefits of relationship mapping and how it helps to paint such a picture. Some people refer to this as “mapping key stakeholders or influencers,” or “political mapping.” It doesn’t make a difference. According to industry research, there are on average around 5 decision makers in a large B2B deal. Your reps need these votes, and they need to figure out how to get them.

A relationship map is only as meaningful as the information on which it is built. It is a key component in deal strategy and it should drive the action plan. Here are five ways your sales people should be leveraging relationship maps to inform and execute their deal strategies:

#1 – Influencer Role

After identifying the members of the buying center on a basic level (their titles, job functions, etc.), your sales people should then determine each stakeholder’s role as it relates to the buying decision. Who are the decision makers, influencers, sponsors, coaches, and so on? If the voting is tied at the end of the evaluation, who breaks the tie?

Sales people often assume that the person leading the evaluation is a decision-maker, but in reality, that person merely influences a buying decision (a “recommender”), or has no effect on the decision whatsoever. Have your reps look for evidence from prior, similar evaluations.

Information to Uncover: Who else was involved in a prior, similar project? Whose approval was needed? Were there other levels of approval after the project team made their recommendation? Has a project ever NOT been approved after the team selected a vendor? Why?

Your reps should focus on finding a “coach” within the buyer’s organization. A coach is someone who will expend political capital on your behalf. They want you to win. Not to be confused with the people who always agree to meet over coffee, then spill everything that is going on. These people are “parrots.” They’ll talk to anyone.

#2 – Influencer Level

A person with a high level of influence has the ability to drive decisions regardless of title or authority. Reps can easily misjudge the amount of weight a key player’s influence carries in a deal if they only look at title; therefore, the questions your reps are asking should seek to uncover each person’s level of influence in the purchasing decision. And remember, there is often a person of relatively low title who has the ear of the most influential people in the organization. In the old TV show M*A*S*H, the character Radar O’Reilly was the lowest level clerk, but Colonel Henry Blake never made a decision without his input. It’s amazing how often life imitates art in this regard.

Information to Uncover: How long has the person been in their role? How long with the company? Where did they work before? Remember, when people move to executive levels at new companies, they often bring their entire team from the last company. These people are the internal trusted advisors and power brokers, so find out as much as possible about the relationship between Person A and Person B. Who hired whom? Who are the rising stars?

Additional research on the web and social media can provide even more information about influence level. Have your reps search for indicators such as rewards/recognition, involvement in professional associations, and relationships with other people of high influence.

#3 – Strength of Relationship (not to be confused with frequency of contact)

Where do we have existing relationships that can be leveraged, and how strong are those relationships? A lot of reps will say, “We have a good relationship,” but what does that really mean? Does it mean that the prospect will name their first-born son after this sales person? Or, does it mean that if the sales person offers a free trip to the Masters in Augusta, the prospect is willing to attend?

Information to Uncover: Have I delivered business value to this person (not just coffee or drinks)? Do they see value in our relationship? What is missing in our business relationship and how can I improve it?…Ask them to do something for you! This could be a number of things, such as an introduction to another key player in the organization. Again, if a stakeholder is willing to expend some political capital on you, chances are that the relationship is strong.

#4 – Preference Level

Many sellers have no idea how their customers actually feel about their solution. Sales professionals often mistake a collegial relationship as a vote for their product. Just because they like you, doesn’t mean they are going to chose your product. Each of the key players involved in a deal has their own level of preference, whether it’s for you, for another supplier’s solution, or for the dreaded “no decision” (a.k.a. do nothing). Your reps should be gathering objective feedback to gauge this sentiment.

Information to Uncover: What are the chances of not moving forward with any vendor? Why? Ask for their vote, directly or indirectly (“Have we demonstrated more value than any of our other competitors?” “Significantly more value or just a little more?”). Then, triangulate this feedback with other members of the team to see if they say the same thing. If Bob says he’s voting for you, but Susie says Bob is voting for the other folks, you need better information.

#5 – DiSC Profile (communication style)

Identifying the DISC profile for each stakeholder can help your reps to build rapport early on, predict behavior later in the sales cycle, and increase preference levels where they are low. In a nutshell, DiSC allows you to assess a person’s communication style simply through observation – No need to awkwardly ask your customer to take a test. If your customer is a “net, net, get to the point” kind of person, and you are waxing poetic about the value other customers have received, you have just missed the boat in building a relationship.

Information to Uncover: What is my DISC profile? What is my customer’s DISC profile? How should I adjust my actions accordingly?

For key players who are task-oriented, preference is built by delivering on promises – demonstrating credibility, confidence and reliability. For those who are relationship-oriented, preference is built by getting to know one another on a personal level, and by establishing a high level of trust.

This article was syndicated from Business 2 Community: How To Leverage Relationship Mapping To Inform And Execute Deal Strategies

More Sales & Marketing articles from Business 2 Community: