Despite all the uncertainty in the world around us, one thing is for sure: if Spring is here, so is tax season.

Are you ready? Whether you will take advantage of the government’s extension of 90 days, or whether you plan to submit your business taxes by April 15, 2020, you need to be prepared.

Do you update your books throughout the year? Are your tax documents organized, and have you identified the most business deductions? By finding the most deductions, you can minimize taxes and keep more of your hard-earned money. Are you on time paying quarterly payments?

If you don’t manage your taxes correctly, you can encounter problems later in the year. When you are running a small business, you often are working 24/7. We don’t want any of the details to escape you.

Here are ten valuable tax tips so that you have everything you need as the tax deadline nears:

Use the Right Software

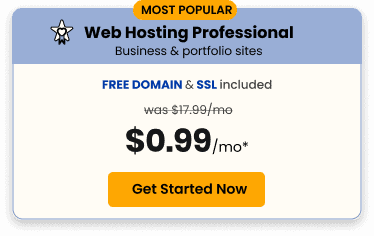

Use specially designed software like Yahoo Business Maker to set up your business entity, whether an LLC, C-Corp or nonprofit, and Federal Tax ID (EIN). You need both for tax purposes.

Also, using the right software that includes a POS system, you can keep track of all sales, manage inventory, and manage store taxes. These items can be exported and included in your tax preparation. Gone are the days when receipts cluttered your desk and wallet. Now you can make it easy on yourself to stay organized.

Determine which business tax return you need to file based on your business entity

Do you run your business as a sole proprietorship or as an LLC or a corporation? Each entity will require a different tax return to file.

For example, if you operate as a sole proprietorship, you can report your business income and expenses on a Schedule C.

If you use a corporation or treat your LLC as one, then you must prepare a separate corporate tax return on Form 1120.

Check out resources on the web that can help you determine which term best fits your business entity.

Be aware of all tax filing deadlines

Don’t incur unnecessary penalties by filing your taxes late. Stay on top of the current deadlines. There are multiple deadlines every month of the year, depending on your business.

If you use a Schedule C, it becomes part of your Form 1040 and is generally subject to the same April 15 deadline as your other taxes.

Don’t forget your self-employment tax, which consists of Social Security and Medicare taxes. It compares to the taxes which employers withhold from their employees’ paychecks.

As of this posting the tax rate is 15.3% of net earnings — 12.4% Social Security tax plus 2.9% Medicare tax. Up to $128,400 of your net self-employment earnings will be subject to the Social Security portion of the tax, but there’s no limit for the Medicare portion.

Be organized

Whether you use a cash or accrual accounting method, you should be using the correct accounting software for your business, which will enable you to gather records quickly and distribute them to the appropriate categories (e.g., Business travel; Staffing and Payroll.)

The cash method is the most common accounting method for individuals and small businesses. It’s more straightforward for accounting and tax purposes.

You account for income for the tax year in which you received it, and expenses are considered for the tax year in which you paid them.

Accrual method

Under this method, you account for income for the tax year in which you earned the right to receive it, and you can determine the amount owed with reasonable accuracy. For example, if you’re a freelance graphic designer and finish a job in December 2020 but don’t get paid until January 2021, you’d still report the income on your 2020 tax return.

When you choose your accounting software, you will want to focus on your own needs and find one that is easy to use. Look at cloud applications which can be accessed from anywhere using a smartphone, tablet, or laptop.

Set up a savings account for taxes

Set up a savings account and avoid fines and penalties if you need to pay estimated quarterly taxes. Open a separate savings account just for taxes. This will help you keep your income organized and simplify your banking.

Depending on your income, business structure, and other factors, you’ll probably want to transfer between 15 to 30 percent of your profit into your tax savings account.

Just remember to be aware of the tax implications; any interest you earn on a savings account is considered taxable income that you must report to the IRS. Be sure to be able to access your checking and savings account from your desktop. For convenience and to simplify your accounts, you may bank with an institution that provides you with your main business credit card.

Gather all essential records

Organize all your records, including your Federal Tax ID (EIN), balance sheet, income statement, payroll records, and any receipts/statements with your accounting software.

You will find it easy to export the necessary figures into your tax forms because your accounting software can help you keep track of all sales, inventory, and taxes. You can monitor your business from your dashboard during tax season and beyond.

List all your deductions

Review your records for deductions and tax credits and include your mileage expenses, charity contributions, home office deduction, and office equipment. Other deductions valuable to small business owners include vehicle expenses, bonus depreciation, and professional services.

If you would like to expand your learning with free webinars aimed at small business owners, do some research on offerings that cover both streamlining your business and other timely topics.

Keep Track of carryover deductions

Deductions for things like capital losses, net operating losses, home office deductions. or even large charitable donations, when not fully used in one year, can carry over to a future year. These deductions may reduce next year’s tax bill in a helpful way.

Consider hiring an accountant

Some business owners have many strengths, such as bringing in business, creating new products, and working with clients. Yet working with the government is not one of them. You can save yourself time in keeping up with the latest tax laws if you hire an accountant who is skilled at this.

If you have just started your business and want to set up systems to give it a solid foundation, hiring an accountant may make perfect sense. You have a professional on the team who will help to manage growth and pay attention to tax details, while you go out and grow the business.

An accountant can also help you do the financial analysis, which you may find you are too busy to do. This professional can also help you handle audits and manage cash flow.

If you can follow these ten tax tips, not only will your business be sparkling and energized following this Spring cleaning, but you can look forward to a year of increased organization, steady expansion, and growth.