There’s a lot of attention been paid to Forrester’s recent projection that 1 million B2B sales people are going to lose their jobs to self-service eCommerce by 2020 in the US alone. Their report highlights the growing disconnect between B2B buying preferences and traditional B2B selling behaviors.

But the projected decline in sales force numbers isn’t universal. Forrester identify 4 types of B2B buying environment and match them with 4 types of sales profile – and one of those sales profiles isn’t in decline – it’s actually projected to grow. Unsurprisingly, it’s all connected with the value that sales people can bring to these different buying environments…

4 buyer archetypes

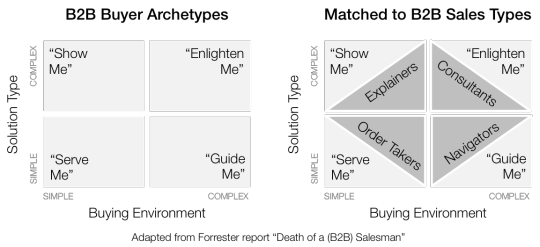

Forrester’s report – “Death of a (B2B) Salesman” – by Andy Hoar, Peter O’Neill and others – includes a wealth of information, but I’d like to concentrate on my interpretation of one of the most interesting aspects of the report – the alignment between Buyer and Seller archetypes. Forrester’s 4 B2B buyer archetypes are defined by the relationship between the complexity of the product or service and the complexity of the buying environment. Let’s delve into these two dimensions in a little more detail:

Product/service complexity

High-complexity products and services tend to be expensive considered purchases – they are often initial purchases (effectively “design wins”) rather than repeat purchases. Their value may not be immediately obvious to the buyer. As well as selling the solution, the vendor may need to persuade the prospect of the need for change. Classic examples include the purchase of an ERP or CRM system, or the delivery of transformational business consulting.

At the other end of the scale are low-complexity products or services requiring little or no customisation that can be bought against a simply defined specification. Competitive products are often hard to differentiate and issues such as cost, availability and/or an existing purchasing relationship are often central to the value proposition.

Buying environment complexity

High-complexity buying environments typically involve multiple stakeholders and a lengthy multi-stage buying decision process. Very often the challenges of getting internal alignment are as complicated as are the challenges of identifying the right solution. This is a buying environment that often requires orchestration.

Low-complexity buying environments, on the other hand, are often transactional in nature, with fewer people actively involved from the prospect organisation. The buyers often know what they want, require minimal education, and are looking for the simplest possible purchasing environment with – at the extreme – little or no human interaction to get in the way.

4 Distinct Quadrants

Effectively, the results in 4 distinct quadrants, each with a dominant buyer type and a dominant sales person type:

What Forrester describe as “Serve Me” buyers (simple product/solution and buying environment) are best served by an “Order Taker” sales model, which may or may not involve any human intervention. The customer’s questions are often best addressed on-line rather than through conversation. Any conversation that does take place is unlikely to be complicated. This is where the deepest cuts are happening to human sales resources: Forrester project that 33% of these order taker sales jobs will disappear by the end of the decade. I’m surprised that the figure isn’t higher.

“Show Me” buyers (complex product/service but a relatively simple buying environment) have a budget and a relatively simple decision path to navigate internally, but don’t know enough (and/or can’t learn enough online) about the product/service category to make the decision unaided. Forrester identify the “Explainer” sales role as being best suited to this environment: they help the prospect to gather and interpret the information they need to compare and choose between alternative options. Deep solution familiarity is more important than political nous in these roles. Forrester project that 25% of these roles will disappear before the decade is out.

“Guide Me” buyers (simple product/service but a more complex buying environment) are best served by what Forrester call the “Navigator” sales model or archetype. They know what they want to buy, but may need help from a sales person in mapping, navigating and orchestrating multiple internal stakeholders and/or budget resources. Political nous is more important than deep solution familiarity in these sales roles. Forrester project that 15% of these Navigator roles will be eliminated by the end of the decade.

The fourth and final buyer type is the “Enlighten Me” buying team – these are almost never individuals, but multiple stakeholders. This involves a complex product/service plus a complex buying environment scenario. The buying team may be undecided or unaligned as to what they need, who best to buy it from, and how to finesse the complex internal decision making and approval processes. This calls for what Forrester describe as the “Consultant” sales model – and it’s the only sales archetype whose population is expected to grow over the course of the decade – by around 10%. These consultants are at the pinnacle of the sales profession – able to combine deep solution familiarity with significant political nous.

I like Forrester’s model. It goes beyond the simple binary transactional consultative sales divide to acknowledge that both the solution on offer and the buying process can have different degrees of complexity. It recognises that initial “design win” purchases may require a consultative sales model but that subsequent servicing and expansion of the account may be better served through a different model.

The Role of Digital Sales Enablement

Digitally enabled sales models are likely to predominate in the Serve Me / Order Taker scenario. But even in a Enlighten Me / Consultant model, the sales and buying experiences can be enhanced and made significantly more effective by intelligently combining human and digital resources. I am convinced that the organisations that manage to strike (and evolve) the most effective balance will gain significant competitive advantage over organisations that cling on to old-fashioned notions until they are long past their sell-by date.

What do you think? Can you position your sales organisation into one or more of these quadrants? How are you trying to align your sales roles and competencies with your customer’s buying preferences? What role is digital sales enablement playing? And how do you see this all evolving in the future?

This article was syndicated from Business 2 Community: 4 types of B2B buyer = 4 types of B2B seller

More Sales & Marketing articles from Business 2 Community: