Earlier this week, Entrepreneur ran a story about the Greek Bailout Fund, a crowdfunding campaign on Indiegogo started by Thom Feeny, 29, of London, England. The mission of the campaign is simple: to tap the power of the people to help the beleaguered country with its desperate financial situation.

After just four days, 82,000 people have raised more than 1.4 million euros ($1.5 million) for the cause. Still, that’s only a fraction of the campaign’s 1.6 billion euro goal. (The 1.6 billion is the amount that was needed for Greece to make its payment to the International Monetary Fund on Tuesday, which it failed to do.)

While Feeny’s idea and sincerity are noble, one has to wonder about the practicality of such an undertaking. Entrepreneur reached out to some experts to see whether the Greek Bailout Fund could accomplish its goal, even if only in a symbolic way. Here’s what we’re wondering:

Related: Girl Scouts Raise $250,000 After Rejecting Donor Who Didn’t Want Funds to Go to Transgender Scouts

1. How would Greece get the money?

It’s not yet clear how Greece would get the money – check? carrier pigeon? PayPal? – but the country has had a solidarity account for public donations that has been open since March 2010.

Sally Outlaw, a crowdfunding expert from Peerbackers.com, thinks Greece won’t have any problem taking the funds. “It’s a donation. Any entity can accept it. I would compare it to U.S. citizens who donate capital back to the U.S. Treasury towards our own debt.” She added that because this is a donation-based investment, not an equity- or debt-based investment, she can’t imagine that any laws involving international finance or taxes would come into play.

In a statement, Indiegogo’s CEO Slava Ruben made it clear that the website would make sure Greece got the funding if Feeny’s campaign reaches its goal. “Once the campaign reaches its goal, Indiegogo will collaborate with the campaigner to get in touch with Greek authorities and determine the best way to transfer the funds to the Greek government,” she said.

Related: 6 Ways to Use Crowdfunding for Product Development

2. Now that the deadline has passed, what does this mean for the campaign, which still has time left to reach its goal?

If Greece doesn’t agree to a deal and receive bailout funds from other countries’ governments, the country could end up owing even more money. Interest is being compounded on its debt each day, which means that the amount of money it needs to stay afloat is a continuously moving target.

That means the crowdfunding campaign is even more unrealistic and less practical than it was a few days ago. “Nobody ever raised over a billion dollars through an online crowdfunding campaign,” says Kendall Almerico, a business and crowdfunding attorney with law firm of DiMuro Ginsberg. “Even if a miracle occurred and somehow the money was pledged, it would not be enough [now that the deadline has passed and interest is being added on].”

Projects on Indiegogo that are listed as “fixed funding campaigns” only receive the money donated when they hit their goal. The Greek Bailout Fund is in that category. So, while many donors noted that they’d like for the money to be given to Greece regardless of whether or not the goal is reached, that won’t happen. If the campaign falls short, the money will be refunded to donors.

Related: Will Equity Crowdfunding Buyers Be Able to Sell Their Shares?

3. Feeny promised a postcard from Greek Prime Minister Alexis Tsipras to all donors who pledged 3 euros. He has not actually spoken to Tsipras about the campaign, so how can he offer that reward?

There are limits to the types of incentives organizers can offer on the crowdfunding site. Prohibited perks include alcohol, weapons and, in Feeny’s case, a small Greek island. Yet, crowdfunding sites like Indiegogo don’t enforce the delivery of rewards promised. “They play no role in reward delivery, which is one of the shortfalls of reward-based crowdfunding,” Outlaw says. “The platforms take no responsibility for this aspect.”

This means that the Londoner is able to offer a correspondence from Tsipras to contributors regardless of whether the politician agrees to follow through, and Feeny won’t face any consequences. Indiegogo’s Terms of Use say, in part:

“Campaign Owners are legally bound to perform on any promise and/or commitment to Contributors (including delivering any Perks). If a Campaign Owner is unable to perform on any promise and/or commitment to Contributors, the Campaign Owner will work with the Contributors to reach a mutually satisfactory resolution, which may include the issuance of a refund of Contributions by the Campaign Owner. Indiegogo is under no obligation to become involved in disputes between Campaign Owners and Contributors, or Users and any third party.”

4. Should there be concerns about setting a precedent?

If this campaign succeeds, might it become commonplace for governments to turn to global goodwill in times of financial strife? Almerico isn’t concerned. “This really is not a question of legal precedent, but more one of how far can people push the boundaries of asking for voluntary donations without really having a cohesive plan as to where the money will go,” he says. “This is an ‘all-or-nothing’ campaign, so if he does not raise $1.6 billion, everyone gets refunded. But imagine if he received $10 million in donations, and did a ‘flexible funding’ campaign where he actually gets the money, even if he did not reach the goal? What would happen then? That is the real problem, is if some scam artist tried to take advantage of a situation like this.”

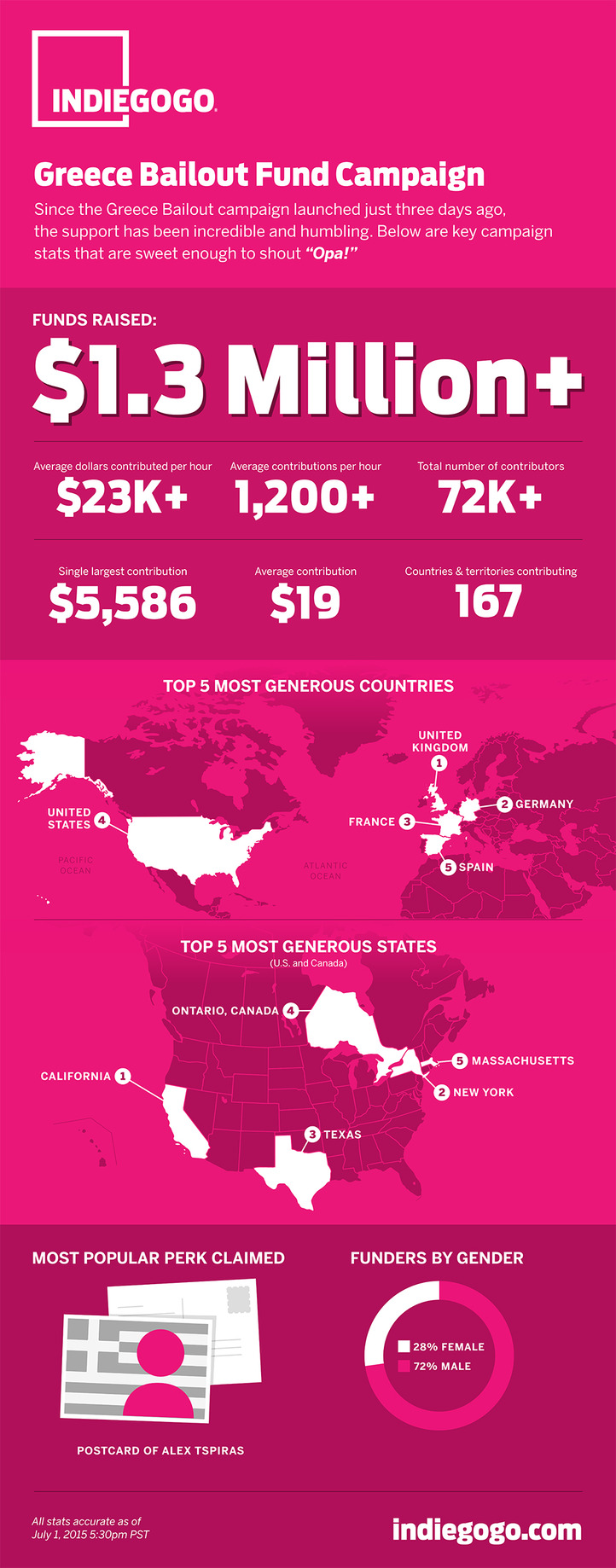

For a breakdown on where the campaign’s money is coming from, check out Indiegogo’s infographic on the Greek Bailout Fund below.

Click to Enlarge

Related: The Numbers Behind Non-Profit Crowdfunding (Infographic)