This year has been dubbed “the year of crowdfunding” because of the exponential growth and rapid changes occurring in that market. And, until now, donation-based and rewards-based crowdfunding (offering products and merchandise in return for donations) have been the two most popular vehicles for entrepreneurs using this concept to fund their startups and other projects.

Related: Crowdfunding Nearly Tripled Last Year, Becoming a $16 Billion Industry

But now there’s a new kid on the funding block: Regulation A+, which could potentially change the landscape by easing restrictions on equity-based crowdfunding.

By way of background, Regulation A+ is a federal regulation that allows private companies to raise capital from the general public. A+ is categorized by two tiers: Tier 1 for smaller offerings raising up to $20 million in any 12-month period, and Tier 2 for offerings raising up to $50 million. A+ is predicted to entice more midsize and larger businesses to crowdfunding, as it essentially allows businesses to go public without launching an actual IPO.

There are several ways that Regulation A+ “ups the ante” for entrepreneurs in the crowdfunding arena. First, businesses participating in equity crowdfunding must be incorporated and meet extensive compliance and reporting requirements due to the complex nature of the business arrangement (i.e., bringing investors into your company).

Second, A+ is set to change public solicitation for equity crowdfunding by loosening restrictions on the use of the web and social media for these offerings. As a result, the crowdfunding market is likely to become noisier than ever.

Due to these and other developments, entrepreneurs planning to launch a crowdfunding campaign (whether equity or nonequity based), would do well to study and emulate the traits that make certain campaigns more successful over others.

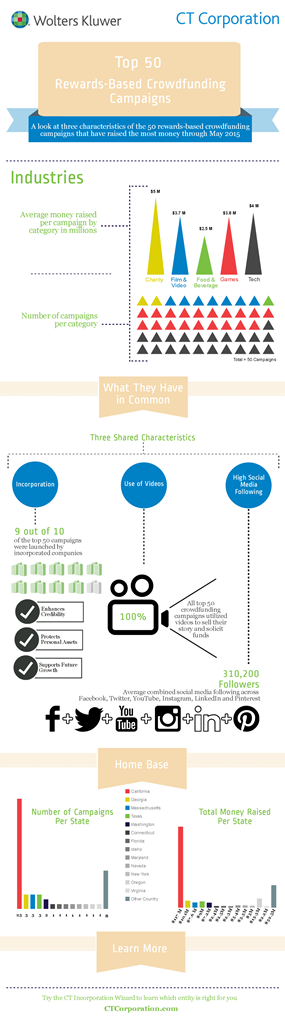

An analysis of the characteristics of the top 50 highest-funded, rewards-based crowdfunding campaigns reveals that the most successful campaigns aren’t launched sporadically but are well thought out and organized. From our analysis, here are three considerations for business owners interested in launching successful crowdfunding campaigns:

- Incorporate your business. Incorporation reduces your personal liabilities; enables you to take advantage of certain loans, grants and contracts; and helps you to stay in compliance with the law. Nine out of ten of the most successful rewards-based crowdfunding campaigns we studied were launched by incorporated businesses.

- Create a video about your business and campaign. Videos help tell your story and are an important element of the social media landscape. One hundred percent of the most successful rewards-based crowdfunding campaigns had them.

-

Build a large social media following. The average social media following for rewards-based crowdfunding campaigns – across six platforms – was 310,202. One campaign had as many as 9.7 million followers, due in large part to its extensive presence on YouTube.

Related: Every Hour, $87,000 Is Raised Through Crowdfunding

When it comes to equity-based crowdfunding, there are still many unanswered questions: What will be allowed and not allowed under the law, for example, and what not-so-obvious liabilities are out there? Thus, any business considering equity crowdfunding – or, indeed, any other form of crowdfunding – should build and maintain relationships with its trusted advisors, such as lawyers and accountants.

Perhaps, given A+, other regulatory developments and new platforms in the pipeline, 2016 will be dubbed “the year of equity crowdfunding.” We look forward to finding out.

Click to Enlarge