If an

accountant is the most important professional to a small business — followed by

an attorney, banker, and insurance agent — then why are most small business

owners calling their accountant only once a year?

Think about

it this way: when you have a good, healthy relationship with anyone, you will

be on the “inside scoop” of whatever it is they know. When you cultivate those

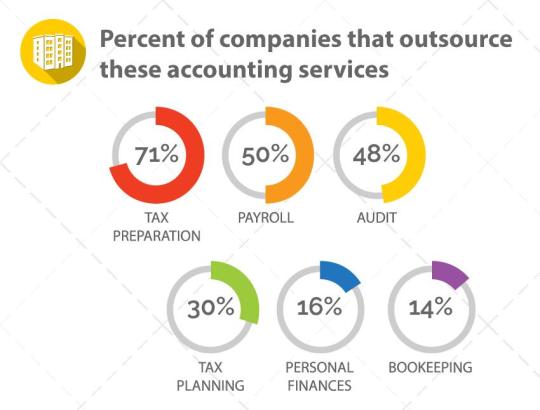

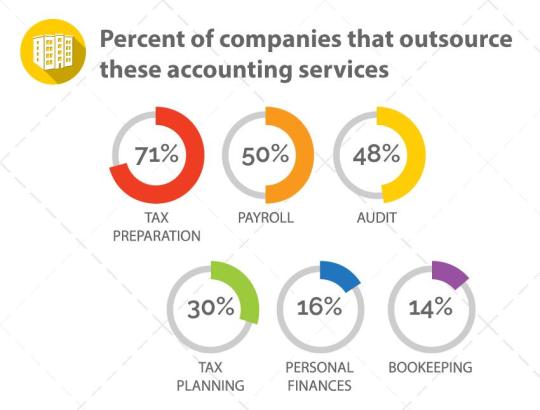

relationships, you’ll be the first to hear about new opportunities and trends. 70%

of small business owners outsource their tax preparation, according to a small

business accounting report by Wasp Barcode Technologies, and most

are satisfied with their accountant.

But how much

do small business owners know about their accountant? Would they switch accountants

if they weren’t the right fit? Since accountants are so vital to the success of

your business, it’s a smart business move to check in often — at least month to

month.

“The best

thing you can do [for your small business] is work with your CPA on a proactive

basis,” states Robert Gambardella, a Conn.-based CPA and co-author of the

book Secrets of a Tax Free Life, told Leslie Ayers at Intuit. “Find someone who is more than just your

tax preparer. You really need a year-round trusted adviser.”

In short,

seeking out accountants once a year during the busy tax season isn’t the

smartest strategy. Below are the top reasons why you should be regularly cultivating

your relationship with your accountant.

1. Be sure your accountant is the right

person for the job.

Everyone has

a different work style and approach. Does your accountant’s preferences match

your own? This might not seem important, but if you’re paying someone to handle

one of the most important tasks of your business, then you better be getting

your value’s worth. You wouldn’t hire an executive without vetting them first,

so don’t hire the first accountant you meet because you think they’ll be able

to do the job. If their communication style is different than your own, you

might find working together to be unproductive.

When you’re

shopping around for an accountant, make sure you understand their exact charges

and services. Don’t equate value with the lowest price. And always get

recommendations from other small business owners and those in your industry. Furthermore,

make sure your accountant is a Certified Public Accountant (CPA), which

requires them to pass certification exams and attend continuing education

courses.

2. Be sure your accountant is aware of

your goals.

It’s

important to have a close relationship with your accountant so that they are

fully aware of the expectations, issues, and operations of your business. If

any of those things change, your accountant needs to know immediately. An

accountant is not just someone that files your taxes at the end of the year;

they are also there to advise you about your business. If they’re unaware of

your goals, they can’t help you think strategically about the future. An

experienced accountant can offer business advice from projecting costs on

upcoming deals to investments that you should be looking into to add value to

your business when the time is right.

3. Be sure your accountant is aware of

any transitional times in your business.

If you’re

ready to grow your company, your CPA needs to know. If you’re thinking about

selling your company, your accountant should be one of the first people you

call. The more they understand what is happening with your business, the better

they can advise you on next steps.

An

experienced accountant can help you control costs to meet benchmarks in your

business, especially during year end taxes. They can analyze your financial

statements and give you an accurate picture of your company’s health.

4. Be sure everything is in order.

Any business

owner knows how crucial it is to always have accurate records, even in the

beginning stages of your business. Checking in with your accountant once a year

doesn’t make sense if your want to be proactive instead of reactive. It’s often

too late if you wait this long because errors need to be caught early to

prevent future errors from happening during the year.

5. Be sure you’re up-to-date on changing

laws and regulations.

Many of the

laws about expenses and deductibles change frequently and differ from state to

state. Always use a local accountant because these laws can be complicated when

you cross state lines. An experienced accountant will keep you up-to-date on

any changes in the law and tell you exactly how the new regulations affect your

business.

Remember, your accountant is more than someone who

crunches numbers for you once a year. They’re your strategic business partner

who knows the law and can advise you on how to reach your goals while reducing

costs. Why wouldn’t you want to meet with them often if these are the benefits

that they can add to your business? The bottom line: be proactive in running

your business and cultivate your relationship with your accountant. It is important to re-evaluate your

relationship with your accountant every three to five years to see if they are

still the right fit for your business.

Peter Daisyme is the co-founder of Palo Alto, California-based Hostt,

specializing in helping businesses with hosting their website for free,

for life. Previously he was the co-founder of Pixloo, a company that

helped people sell their homes online, that was acquired in 2012.