As the founder and CEO of Applico, I often advise technology startups on how to incorporate platform dynamics into their business model. I was interested in gathering additional data to support our point of view, so I turned to publicly available S&P 500 data to help entrepreneurs better understand the size of the platform opportunity.

Simply put, a platform is a business model that creates value by facilitating exchanges between two or more interdependent groups, usually consumers and producers (think Uber). And the S&P 500 is the strongest benchmark for the U.S. stock market. Analyzing it helps us uncover how well represented platforms will be in the index and their economic contribution in the upcoming years.

As an investor or startup founder contemplating their next business opportunity, the following data presents a compelling argument for both investing in and building platforms.

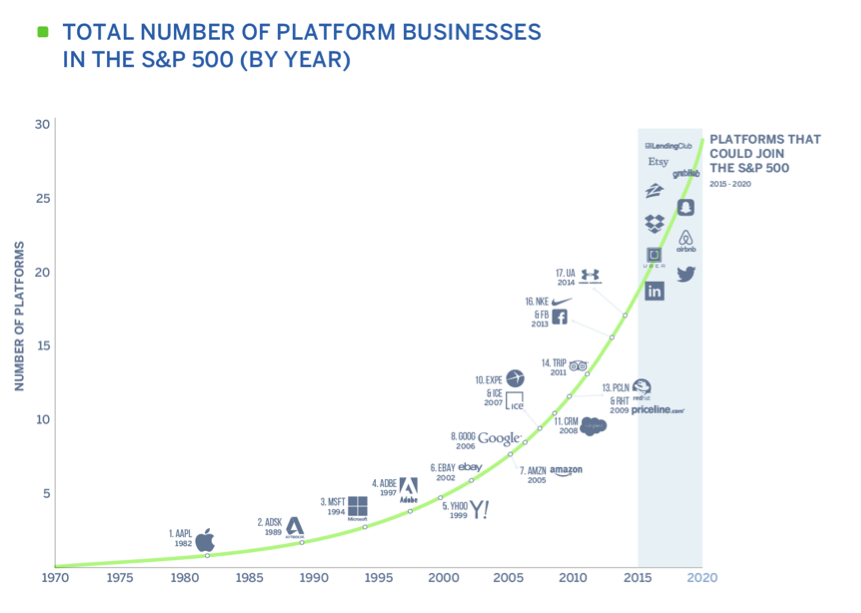

In five years, 5 percent of the S&P 500 will be platform businesses based on the following platform trend line.

Platform representation in the S&P 500 has and will continue to increase exponentially because platforms have distinct advantages over more traditional business models, such as more favorable cost structures, higher profit margins and the ability to scale to a size that traditional businesses can’t.

Potential public platform companies that could join the S&P 500 over the next few years include LinkedIn, Twitter, Zillow and GrubHub. Uber, Snapchat, Airbnb, Dropbox and Pinterest also could be future candidates once they go public, as their current valuations already exceed S&P 500 market cap requirements. Additionally, many existing enterprises will evolve by incorporating platform business models and network effects into certain parts of their value chain (e.g. Nike introducing Nike+ in 2013 and Under Armour’s acquisition of MapMyFitness in 2014).

In 25 years, 50 percent of the S&P 500’s collective net income (profits) will come from platforms.

At Applico, we calculated the net income generated in the third quarter of 2014 by the 10 true platform companies in the S&P 500. These include Apple, Google, Facebook, Yahoo, eBay, Microsoft, Adobe, ICE, Red Hat and Amazon. We compared their collective net income to the aggregate of all the S&P 500 companies as found in this report. Then, we extended these ratios with our projections for the number of platform companies to be in the S&P 500 over the next 25 years based on our trend line. These projections may seem outlandish, but they reflect the actual growth we’ve seen over the past decade.

S&P 500 platform businesses have improved their net earnings on average by 330 percent in the past 10 years, compared to 16 percent for the overall S&P 500.

Platforms are better at improving their net earnings than linear businesses. The more platforms join the S&P 50o, the more they’ll account for the index’s collective net earnings.

There are currently 39 platforms and 39 linear businesses in WSJ’s Billion Dollar Startup Club.

The even split strongly indicates that platforms are the business model of the next few decades. A much larger percentage of these companies are platforms than there were in previous generations of successful startups. Investment and valuation patterns in the WSJ data provide additional proof.

Platforms raise more equity funding at higher valuations than linear businesses.

Investor confidence in platforms is also 25 percent higher than investor confidence in linear businesses.

| WSJ Billion Dollar Startup Data | Platform | Linear Business |

| Avg. Valuation ($B) | 5.5 | 2.53 |

| Total equity funding ($B) | 24.09 | 14.92 |

| Avg. equity funding / platform($M) | 617 | 382 |

| Avg. equity funding/ avg. valuation | 11.22% | 15.10% |

The delta between the amount invested in a startup and its valuation is wider for platforms than for linear businesses, indicating investors are more confident in the upside of their platform investments.

We believe this data shows how central platform businesses will become to our economy over the next decade. If these trends continue, they will be a key driver of U.S. economic growth in the future.

Alex Moazed is the Founder & CEO of Applico, the trusted advisor to disruptive tech companies with clients like Google & Highland Capital’s portfolio companies.

BusinessCollective, launched in partnership with Citi, is a virtual mentorship program powered by North America’s most ambitious young thought leaders, entrepreneurs, executives and small business owners.